Forecasting – being professionally obliged to make a fool of yourself

You have to pity analysts and financial journalists having to publish their market forecasts. It’s like being professionally obliged to make a fool of yourself.

My prediction for the 2018 year-end position of the FTSE is 7,636 (it is 7,017 at the time of writing, as the draft Brexit withdrawal agreement is published). The truth is no one has any idea what’s going to happen in timescales as short as a year (see my tutorial Predicting the Stockmarket).

Even though we know these forecasts are phoney, we lap them up anyway. Just prior to the introduction of MiFIDII there was a lot of concern about analysts’ research having to be priced and charged separately, where previously it was freely offered to anyone using the sell side’s trading desks. Many people suggested the research and forecasts from these analysts are useless and no one reads them. The clue after all is in the term ‘sell-side’. These analysts are part of the marketing effort for their banks. Where something is offered for free, you can be sure the quality is suspect and no doubt MiFIDII will shake that out and do us all a favour by lowering costs, but I bet there are plenty of people that are happy paying for these so called ‘useless’ forecasts.

The problem with most forecasts is that they assume the current price is the fair price. From this starting position, they make assumptions up or down to arrive at their forecast. To be strictly accurate, their forecast should read ‘If nothing significant changes, next year’s price should be …’. In other words, their forecasts always assume ‘business as usual’.

There’s good theoretical grounds for assuming the current price is also the most accurate fair price. It’s called the Efficient Market Hypothesis and it holds that all publicly known information is already reflected in market prices.

The trouble of course is that something always does happen. Business rarely continues on as usual. Things are always changing, often quite radically. All this market-moving information is not known yet and the subsequent re-pricing renders starting assumptions invalid which makes the output appear worthless when reviewed in hindsight.

However, the fact that forecasters always get their forecasts wrong does not make the exercise useless. It is the forecasters’ assumptions that have value. Investors should have their own model and set of assumptions (perhaps influenced by their own ‘buy-side’ analysts) and the value comes from comparing all these analysts’ assumptions, and the arguments defending these assumptions, with your own.

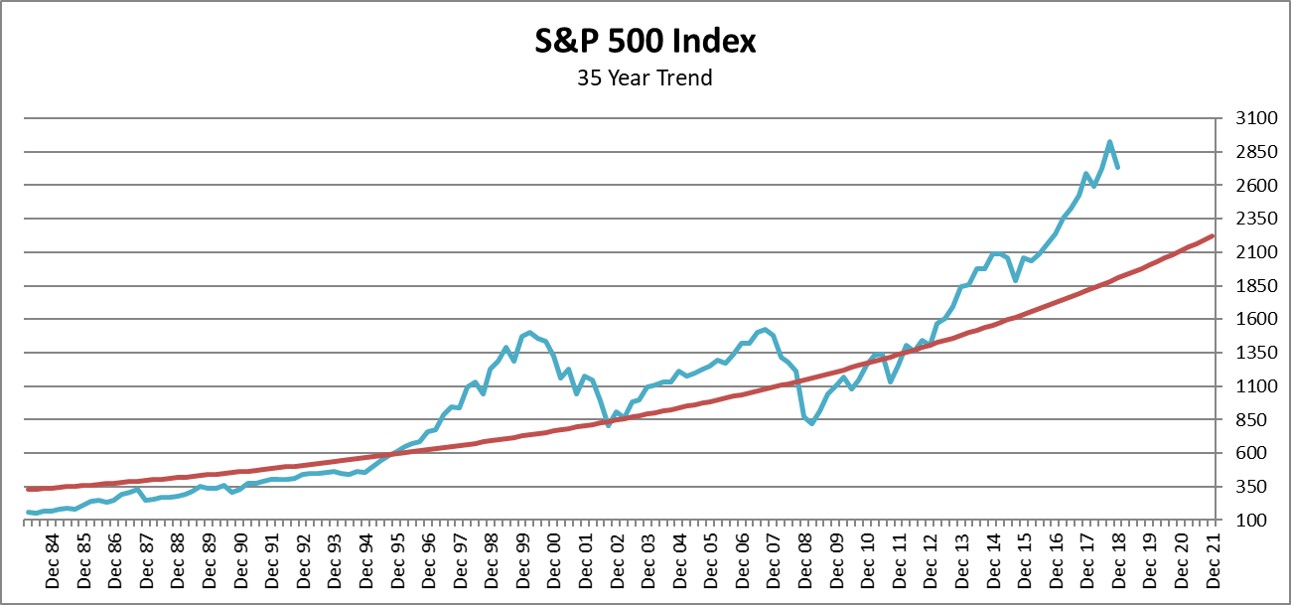

To prove the point, consider my forecast for the FTSE 100 above. You could argue that I too have done nothing but project forward from a steady state. My forecast is only 9% above the current price and if Brexit goes well, that could easily be achieved. Now consider my forecast for the S&P 500. My YE 2018 forecast is 1,903 (currently it is 2,730). Well, now we have a forecast! This isn’t a steady state at all. The point is not whether I am right or wrong, but what do you think about my arguments that today’s US market is over-valued (see chart below).

Instead of taking the current price as being accurate, the red line in the chart above is my estimate of what fair value was in the past and what it will be in the future. From this I derive my forecast of 1,903. From this chart you can see that I think the US market is ~44% overvalued, hence my estimate it will fall. Deciding on whether you agree with me or not, is where my forecast has value.

What this forecast has led me to do is reduce my normal weighting of US stocks by half, so you can see even I don’t have complete faith in my own forecast.