Stock-market heartbeats

The word that best sums up the stock-market is febrile. A market index such as the FTSE 100 or the S&P 500 jump around like a compass needle, swinging back and forth searching for the correct direction. Only it is like a compass where the location of magnetic north jumps keeps changing, sometimes moving substantial distances. The needle never settles because there is always news.

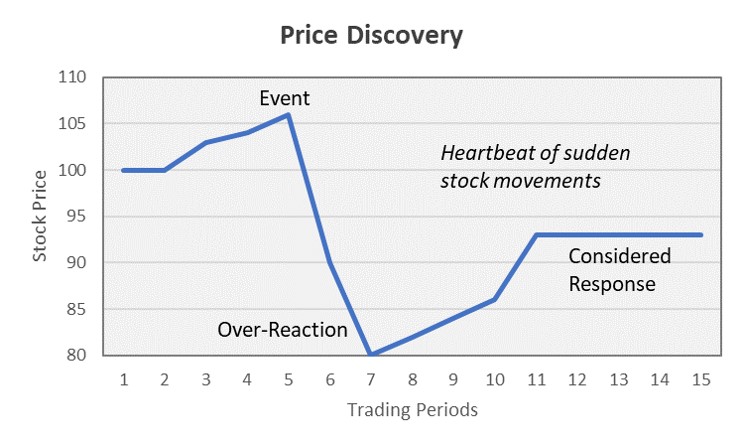

The process of price discovery often involves swinging passed the correct price and having to swing back before finally settling. In cases of significant unexpected events the over-reaction can be quite severe and often the subsequent correction claws back half of the initial price movement. This effect can cause the price movements to look like a heartbeat monitor (see below).

This heartbeat effect has a fractal quality, meaning it applies to trading periods of minutes all the way up to months, even years. And of course, it works in either direction, up or down.

The best way to cope with all this price activity is to ignore it and follow the trend instead. If you want to know in which direction a man and his dog are travelling, follow the man not the dog. The stock-market is like the dog. It will travel far in front of the trend or fall significantly back, sometimes running off in strange directions and runs away for long periods, but – like a dog – it will always come back to follow the trend. And the trend is always to rise gently in line with economic growth.